Carbon Border Adjustment Mechanism (CBAM)

Key elements

The implementation of the Carbon Border Adjustment Mechanism (CBAM) commenced on 1 October 2023. Importers of CBAM goods are obliged to register on the CBAM transitional registry. In addition, from January 2024, they must prepare to file quarterly reports of CBAM imports. CBAM applies to iron, steel, aluminium, cement, electricity, fertilisers and hydrogen that are produced outside the European Union (EU). From 1 January 2026, these goods will be subject to a carbon charge under CBAM when imported. CBAM certificates must be purchased by the importer to cover the charge.

During this ‘learning by doing’ period, you are required to file quarterly reports to the Commission providing details of CBAM goods imported. The first CBAM report was due by 31 January 2024, covering CBAM imports from 1 October 2023 to 31 December 2023. The second report was due by 30 April 2024, covering CBAM imports from 1 January 2024 to 31 March 2024, and so on.

Further information, webinars and guidance documents are provided on the European Commission CBAM webpage. These reports must be uploaded in the transitional registry.

Access to the CBAM transitional registry

The CBAM transitional registry can be accessed at https://cbam.ec.europa.eu/declarant. This link must be accessed on the device that the economic operator's Revenue Online Service (ROS) digital certificate is also saved on. Failure to use the correct device will result in an error message.

Further requirements:

- A valid ROS cert, Customs and Excise (C&E) registration and an Economic Operator Registration and Identification (EORI) number.

- Check that you can successfully get into other EU systems, for example, the Customs Decisions Systems (CDS). Check that you can log into the usual ROS login screen, then access the UCC Customs Systems link.

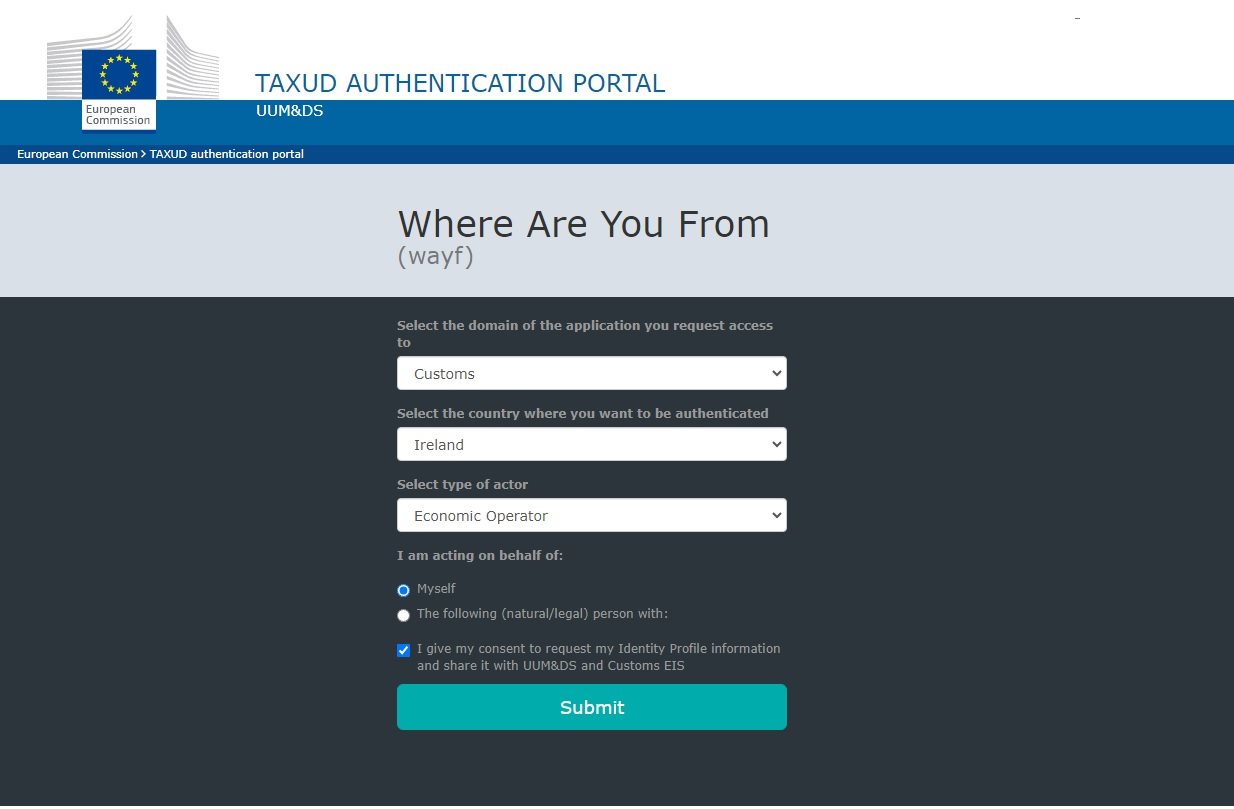

- Please see the screenshot of the login screen below. In the first field, click on 'Select the domain of the application you request access to' and then select 'Customs'. Selecting any other choice will result in an error message.

The full implementation of CBAM by January 2026 will require importers to:

- be authorised as a CBAM declarant

- purchase CBAM certificates to cover the CO₂ emissions generated in the manufacture of the goods they import

- and

- report the quantity of CBAM goods imported (including embedded CO₂ emissions) by 31 May in the year following import.

For further information, please contact:

- The CBAM National Competent Authority - Environmental Protection Agency (EPA). Please email CBAM@epa.ie for any report related questions or technical questions on how emissions are calculated.

- The CBAM Customs Authority – Revenue Customs Division. Please email importpolicy@revenue.ie for customs-related queries, including access to the transitional registry.

In the CBAM's transitional phase, traders will only have to report on the emissions embedded in their imports. They will not have to pay any financial adjustment during this phase. This will give time for businesses to prepare and will provide the necessary information to fine-tune the definitive methodology by 1 January 2026.

Next: The European Union's 'Fit for 55'