Intra-Community supplies (ICS)

What is triangulation?

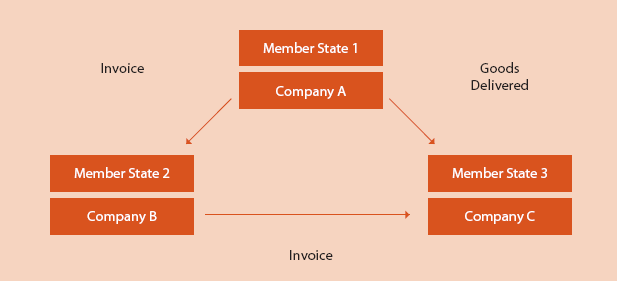

Triangulation involves two supplies of goods between three Value-Added Tax (VAT) registered traders in three different European Union (EU) Member States. For example, where a trader established in one Member State (MS1) sells goods to a trader established in a second Member State (MS2). The goods, however, are delivered to a trader in a third Member State (MS3).

To reduce the administrative and compliance burdens on traders and the tax authorities associated with such triangular transactions, there is a simplification measure. This simplification measure can only operate when the three traders involved are all registered for VAT in the European Union.

In general, the simplification measure works as follows:

- There is a zero-rated intra-Community supply (ICS) from company A to company B.

- The supply is listed in the VAT information exchange system (VIES) return by company A to company B.

- As company B has quoted its VAT number, it has made an intra-Community acquisition (ICA). Company B accounts for this ICA in its VAT return.

- Company B makes a VAT-free supply to company C. Company C accounts for this transaction in its VAT return as a received supply. In this way company C is deemed to have accounted for company B's VAT liability in Member State 3.

Where company C is entitled to reclaim VAT, it takes a simultaneous credit for this transaction in the relevant VAT return.

Transactions involving more than three companies

The simplification measure can only operate in a classic triangulation situation as set out above. If there are more than three companies involved (for example, successive sales between companies in Member State 2), the strict legal position will apply. In such cases, registration may be required in at least one other Member State depending on the precise circumstances.

Next: Evidence required for ICS of goods